CFIUS’ Expanding Role in Gulf South Real Estate Transactions

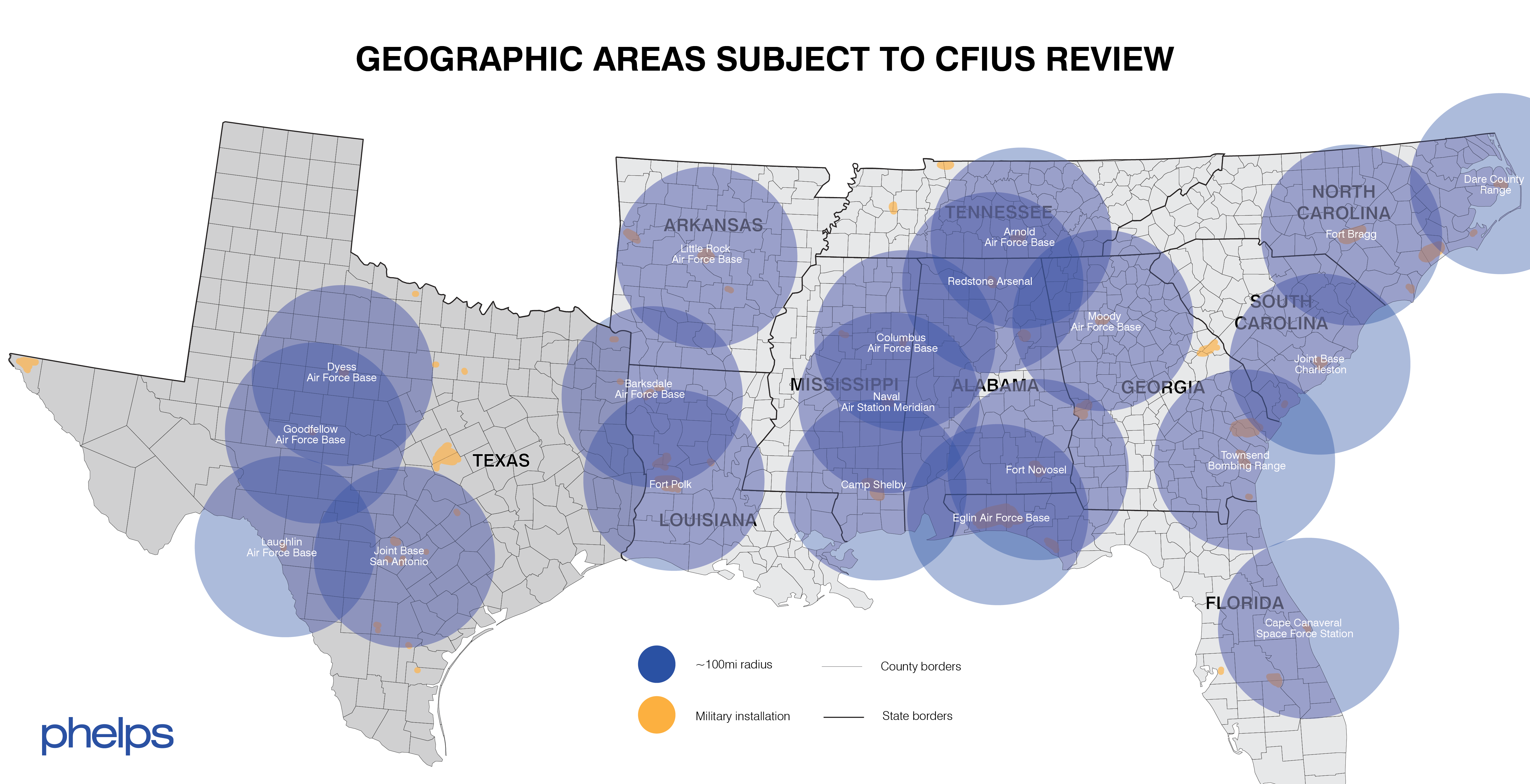

The Gulf Coast is experiencing a surge in renewable energy projects, industrial projects and data center projects throughout our region. When targeting potential project sites, developers and investors should identify early on whether Committee on Foreign Investment in the United States (CFIUS) approval will be needed for the project. This early stage due diligence is especially important in the Gulf Coast due to the high number of military bases and ports within close proximity to potential project sites.

For much of its history, CFIUS operated behind the scenes. Created in 1975, CFIUS assists the President of the United States by reviewing the national security implications of foreign direct investment in the country. Recently, CFIUS has played an expanding role in real estate transactions across the Phelps footprint. Investment decisions by foreign investors increasingly involve a regulatory risk analysis in a transaction’s early stages, a trend that highlights the importance of proactively engaging real estate counsel with CFIUS experience.

In this client alert, we outline CFIUS’ jurisdiction over certain real estate transactions, the consequences of CFIUS’ expanding authority for foreign investors in the Gulf South and potential regulatory developments during the second Trump Administration.

Covered Real Estate Transactions

In 2018, motivated by concerns about Chinese investment in U.S. companies with advanced technology, Congress significantly expanded CFIUS’ authority by passing the Foreign Investment Risk Review Modernization Act (“FIRRMA”). Since FIRRMA’s passage, CFIUS has exercised its authority to review real estate transactions and extended its related enforcement activities, a trend that has particular relevance for real estate transactions in the Gulf South due to the region’s ports and military installations.

FIRRMA expanded the scope of transactions within CFIUS’ jurisdiction by including for review real estate transactions in close proximity to a military installation or a U.S. government facility or property of national security sensitivities. In 2020, the U.S. Department of the Treasury (“Treasury”) issued a final rule in 31 CFR Part 802 (“Part 802”) outlining CFIUS’ authority to review “covered real estate transactions,” i.e., the (a) purchase, lease or concession (b) by a “foreign person” of (c) certain “covered real estate” in the United States. Each element of covered real estate transactions is described in more detail below:

(a) Purchase, Lease or Concession – To trigger Part 802, the real estate transaction must grant the foreign person at least three of the following real property rights: (i) physical access to the property, (ii) the right to exclude others from the property, (iii) the right to improve or develop the property and (iv) the right to affix structures or objects to the property. In practice, nearly every option, sale or lease to a foreign person meets these criteria.

(b) Foreign Person – A “foreign person” is any foreign national, foreign government or foreign entity, or any entity over which control is exercised or exercisable by a foreign national, foreign government or foreign entity. For businesses with complex organizational structures, Part 802 gives CFIUS latitude to assess control on a case-by-case basis and prioritize substance over form. Put another way, CFIUS has authority to “look through” complex ownership structures to determine actual control.

Notably, CFIUS regulations exempt certain real estate transactions involving investors from certain countries based on CFIUS’ determination that those countries pose less risk to U.S. national security. Among other requirements, for an entity to qualify as an “excepted real estate investor,” any foreign person that individually or as part of a group holds 10% or more of the entity’s voting or economic interests must either be (a) a national of an excepted foreign state (and only an excepted foreign state) or (b) an entity organized under the laws of an excepted foreign state.

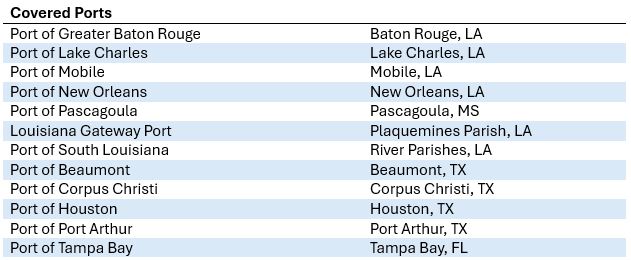

(c) Covered Real Estate – Covered real estate includes property within either one or 100 miles of certain military installations and property that is within or will function as part of specified ports, including large hub airports and top 25 tonnage, container, or dry bulk ports. Real estate within an U.S. Census Bureau “urbanized area” or “urban cluster” is excepted from “covered real estate” unless it is part of a covered port or within one mile of a military installation.